SOIT Barometer – 10 Years of Measuring the Incentive Travel Market in Poland

On September 2, a press conference was held at the InterContinental Hotel in Warsaw by the Polish Association of Incentive Travel Organizers, during which the results of the 10th edition of the SOIT Barometer were presented. The study, which was initiated by Krzysztof Pobożniak (Haxel Events & Incentive), is an original research project. This year’s research partner was Ebury Partners.

The SOIT Barometer is the first and only initiative in Poland that consistently measures the incentive travel market. Since 2014, in cooperation with the association’s members, the study has allowed monitoring the health and prospects of the incentive industry. The latest edition, prepared by the certified agency ABR SESTA, includes results for 2024 as well as a forecast for 2025. The data, compared with previous measurements, clearly show how dynamically this market segment is developing.

The event was supported by the Saudi Tourism Authority. For six years, Saudi Arabia has been inviting tourists seeking unforgettable and unique experiences. It’s a country for those who value exceptional nature, rich cultural heritage, authentic encounters, and traveling off the beaten path. The destination boasts a vibrant cultural identity rooted in centuries-old traditions, while also embracing new forms of expression and development. Visitors have the chance to experience an extraordinary blend of authenticity and modernity.

The event was held under the honorary patronage of Pracodawcy RP.

Key Conclusions from the Report:

- In 2024, SOIT members organized 1,511 international incentive trips (+15% YoY, +680% compared to 2020)

- Forecasts for 2025 indicate further growth in the number of projects

- Budgets are rising – 95% of European trips exceeded 6,000 PLN per person, and 95% of non-European trips exceeded 10,000 PLN per person

- Two-thirds of companies reported an increase in the number of requests for proposals

Number of International Incentive Trips Organized by SOIT Agencies:

- In 2019, the total number of trips was 826

- In 2020, the total number of trips drastically dropped to 193

- By 2024, the number of trips compared to 2022 doubled to 1,321

- In 2025, the number of trips is forecasted to exceed 1,500 groups

In 2024, 36% of agencies organized between 30 and 49 trips, while 14% organized more than 50 trips. The forecast for 2025 shows that the percentage of trips above 50 will increase to 18%.

The distribution of this across Europe and Non-European Countries is shown in the chart below.

Budget Breakdown:

- Between 2015-2019, there was relative stability with a significant proportion of companies indicating no change in the budget for international incentive trips.

- In 2022, a sharp rise in incentive travel budgets was noted, a trend that continued in 2023-24, although the rate of growth is slowing down.

- Forecast for 2025: A larger percentage of budgets is expected to remain unchanged.

European Trips:

- The share of trips with a budget above 6,000 PLN grew from 2015 to 2023, except in 2018.

- In 2023-24, trips with a minimum budget of 6,000 PLN per person accounted for 95% of European trips.

- By 2025, trips with a minimum budget of 6,000 PLN will make up 100% of the trips organized by SOIT agencies.

Non-European Countries:

- Since 2020, the share of trips to non-European countries with a per-person budget of 10,000 PLN or more has been increasing.

- In 2022, trips with a budget of 10,000 PLN or more accounted for 78% of non-European trips, and in 2023, this figure rose to 95%.

- In 2024, the percentage of trips with a budget above 14,000 PLN increased, with further expected rises in 2025, especially in the 16,000-18,000 PLN range.

Number of Requests:

- Nearly all surveyed companies reported an increase in inquiries in 2022.

- In 2023 and 2024, customer inquiries stabilized, but nearly two-thirds still reported an increase.

- Forecast for 2025: Two-thirds of those surveyed expect continued growth in inquiries.

Estimated Number of Participants in International Incentive Trips:

Europe:

- In 2020, there was a sharp drop in the number of participants in European incentive trips due to the pandemic.

- In 2021, there was almost a doubling in the number of participants, and it wasn’t until 2022 that the number of participants returned to pre-2019 levels.

- In 2024, a sharp increase in participants was recorded (almost double).

- Forecast for 2025: The estimated number of participants is expected to rise significantly again.

Non-European Countries:

- For European trips, the number of participants returned to pre-pandemic levels by 2022, while the number of people participating in non-European trips remained lower that year. The recovery was visible only in 2023.

- In 2024, there was an increase in the number of participants, but not as sharply as in European trips.

- Forecast for 2025: The number of participants in non-European trips will continue to increase, but the rate of growth will slow down.

Transport for Incentive Travel:

- Scheduled flights are by far the most popular form of transport, especially for non-European trips.

- In 2024, low-cost airlines were the most commonly used for European trips.

- The use of private transport for European trips has decreased, while for longer trips, this is negligible.

- Coach and train travel make up a small percentage of European trips, and are absent in long-distance trips.

- In 2019 and 2023, LOT was the most popular carrier, but in 2024, the majority of SOIT companies used Emirates.

- Compared to previous years, fewer companies are indicating Lufthansa as their carrier.

- Turkish Airlines saw the largest increase in popularity between 2023 and 2024.

Where Are the Most Incentive Trips Organized?

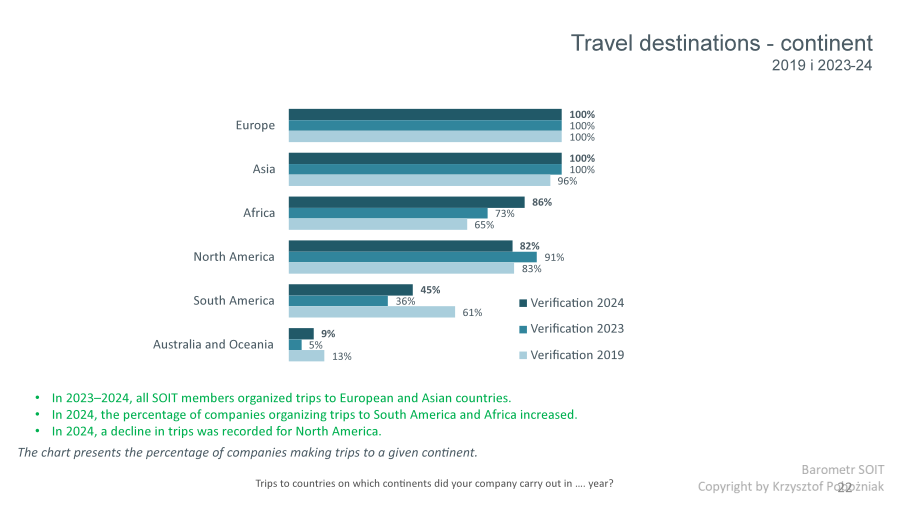

- In 2023-2024, all SOIT members organized trips to European and Asian countries.

- In 2024, the percentage of companies organizing trips to South America and Africa increased.

- There was a drop in trips to North America in 2024.

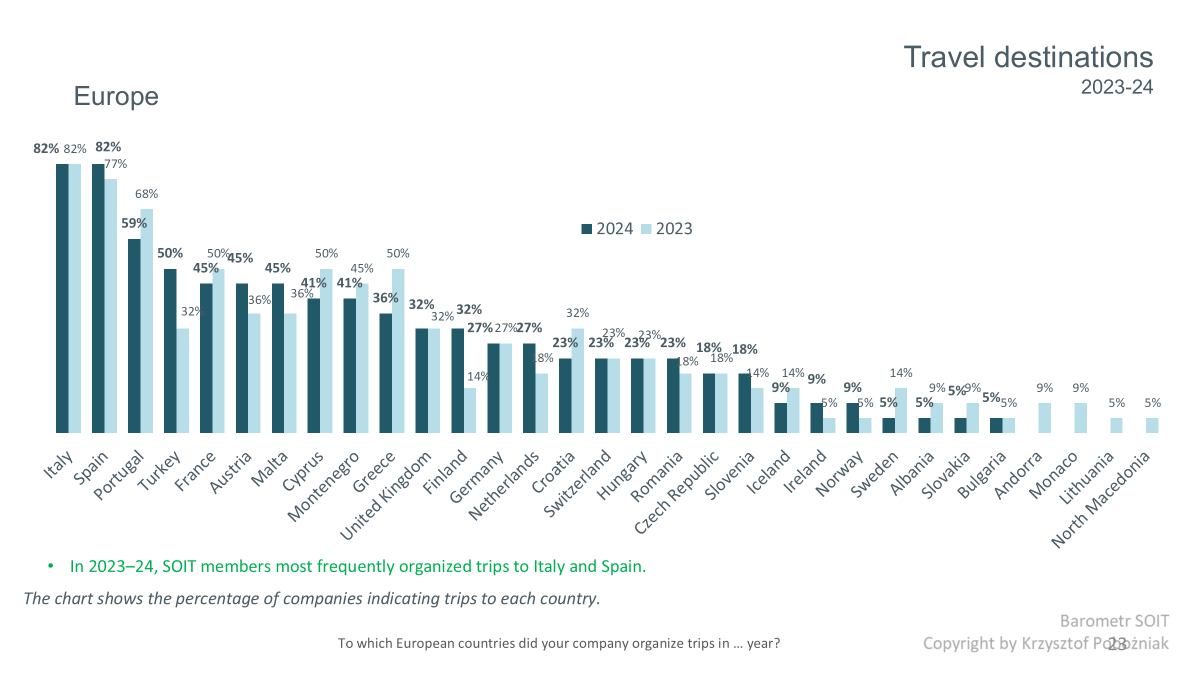

- In 2023-24, SOIT members most frequently organized trips to Italy and Spain.

Asia:

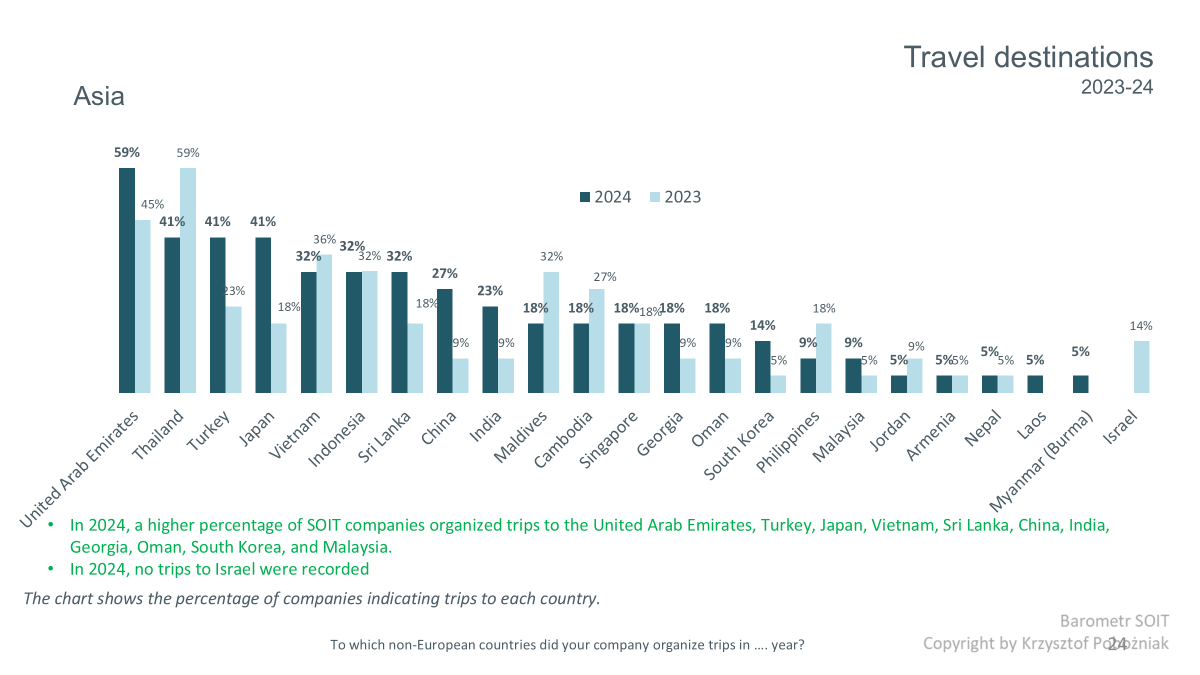

- In 2024, a higher percentage of SOIT companies organized trips to the UAE, Turkey, Japan, Vietnam, Sri Lanka, China, India, Georgia, Oman, South Korea, and Malaysia.

- In 2024, there were no trips to Israel.

Africa:

- In 2023-24, the most popular destinations in Africa for SOIT companies were Morocco and Mauritius.

- In 2024, there was a decrease in trips to Kenya, but a significant rise in trips to the Seychelles.

North America:

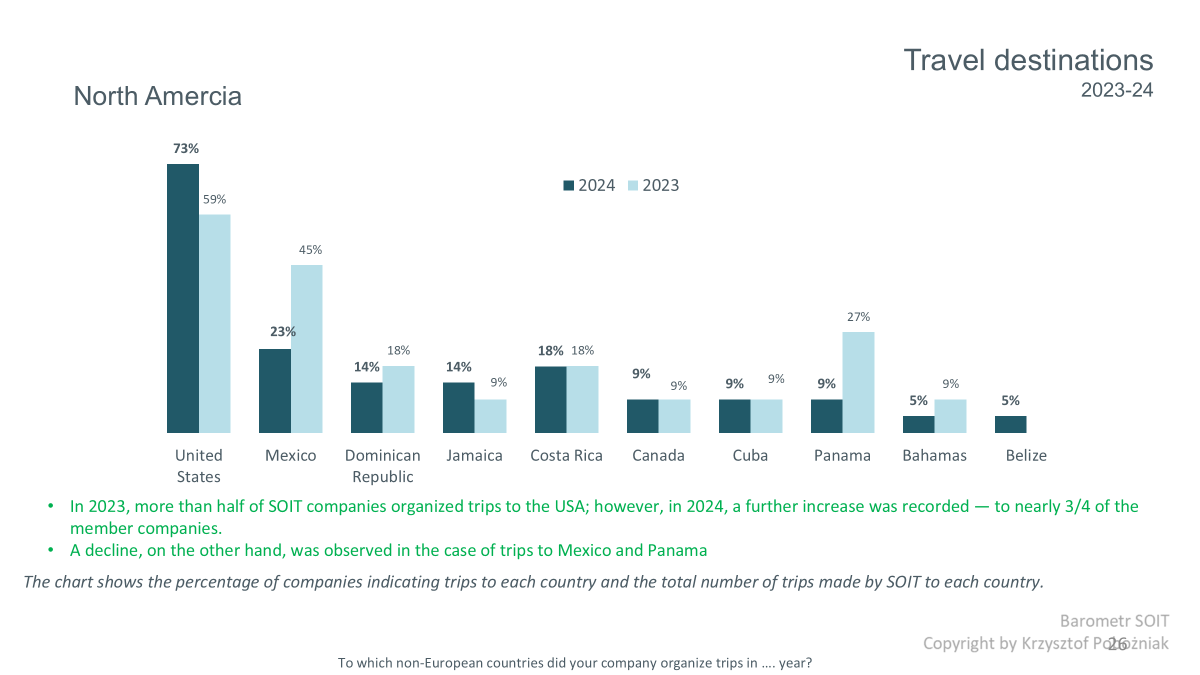

- More than half of SOIT companies organized trips to the USA in 2023, and by 2024, this had increased to almost three-quarters of the member companies.

- There was a decline in trips to Mexico and Panama.

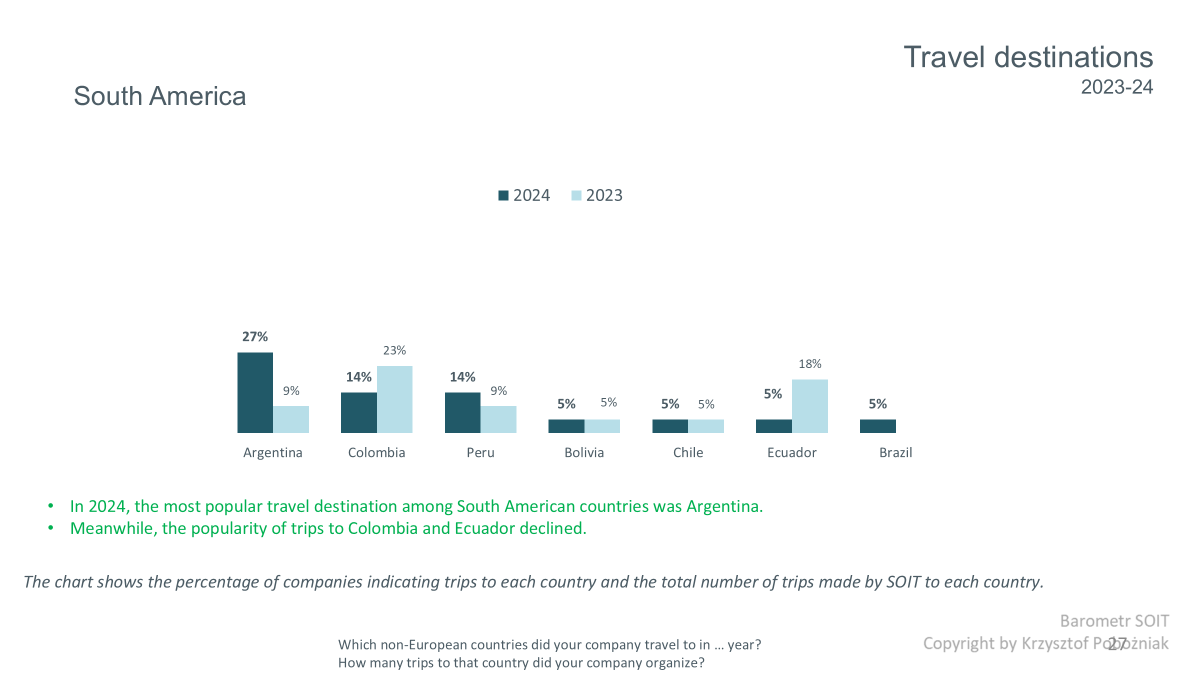

South America:

- In 2024, Argentina was the most popular South American destination for incentive trips.

- Trips to Colombia and Ecuador decreased in popularity.

Australia and Oceania:

- In 2023, only one company organized a trip to New Zealand; in 2024, two companies did so.

- No company organized trips to Australia in 2023-24.

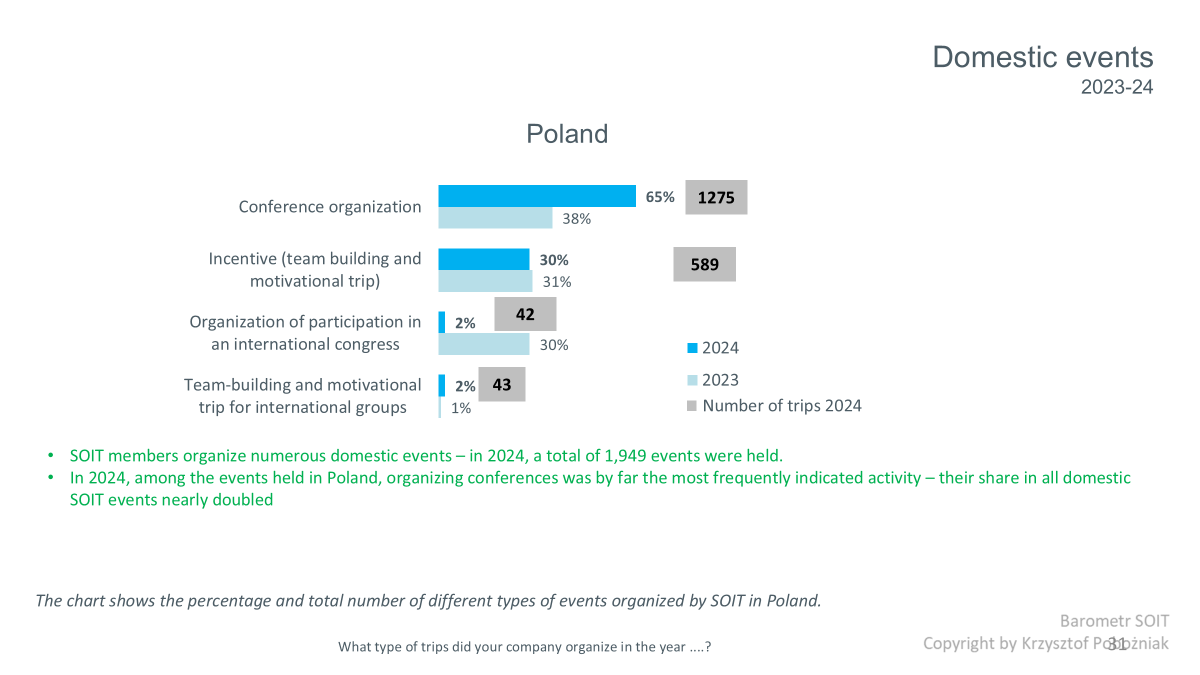

Incentive Trips in Poland:

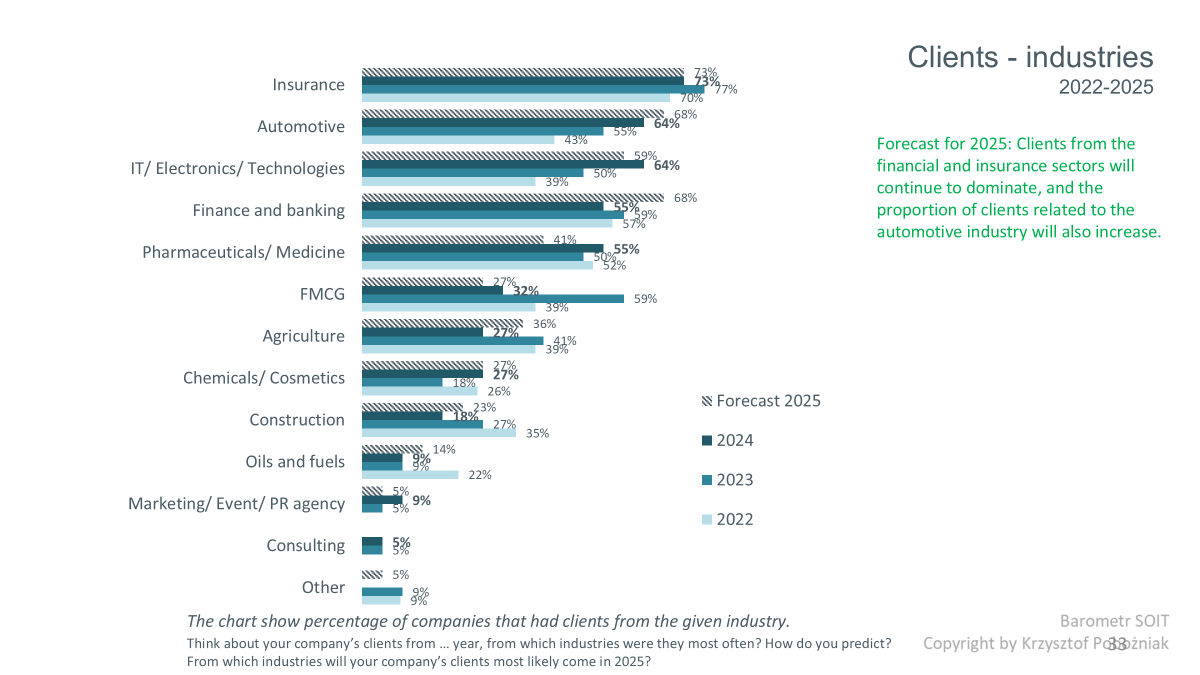

Incentive trips are an extremely useful tool for employee motivation and sales growth. Which industries use them the most?

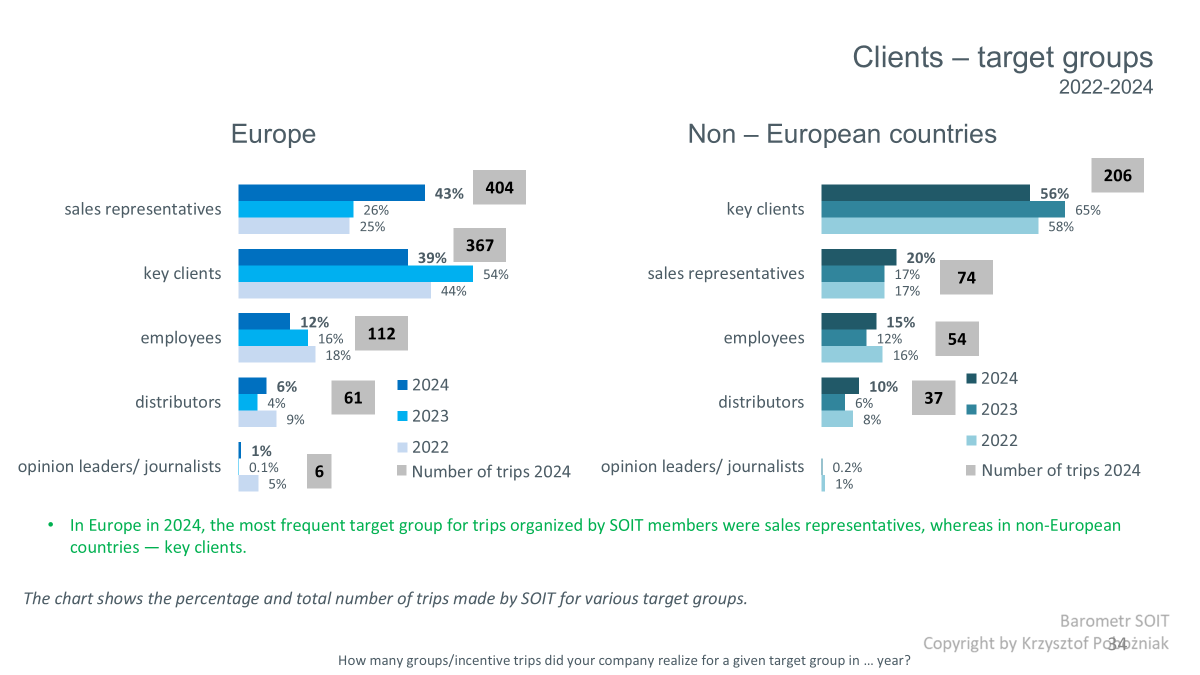

- In Europe, the target group for trips organized by SOIT members in 2024 were primarily sales representatives, while in non-European countries, the focus was on key clients.

- Increasing sales was the most common goal for both European and non-European trips in 2023-24.

- Both for European and long-distance trips, the number of trips focused on relationship-building has decreased over the past three years.

Tenders:

- In 2020, there was a drop in the number of companies participating in tenders, which continued into 2021.

- In 2022, the number of companies participating in tenders increased, though it had not yet returned to pre-pandemic levels.

- A stronger rebound was observed in 2023-24, though only a maximum of six companies participated in any given tender.

- In 2018, compared to 2017, the proportion of companies taking part in tenders lasting at least five weeks increased.

- In 2019, the number of tenders lasting more than five weeks decreased.

- In 2022 and 2023, a lower percentage of tenders lasted more than five weeks, but this increased in 2024.

- In 2018 and 2019, the average preparation time for offers was typically up to eight days, but in 2022, it increased, with one-third of surveyed companies indicating it took 11 days or more.

- In 2023-24, the most common preparation time for offers was 9-10 days.

- From the start of the study until 2023, the percentage of tenders with feedback about the budget increased.

- In 2024, there was a decrease in companies indicating tenders with a budget feedback of 70% or more.

Employment in Member Agencies

A noticeable decrease in the number of employed Project Managers did not occur in 2020, but only in 2021.

In 2022, the number of employed Project Managers increased, but in 2023, a decrease was recorded, which continued into 2024.

Forecast for 2025: The number of employed Project Managers is expected to rise.

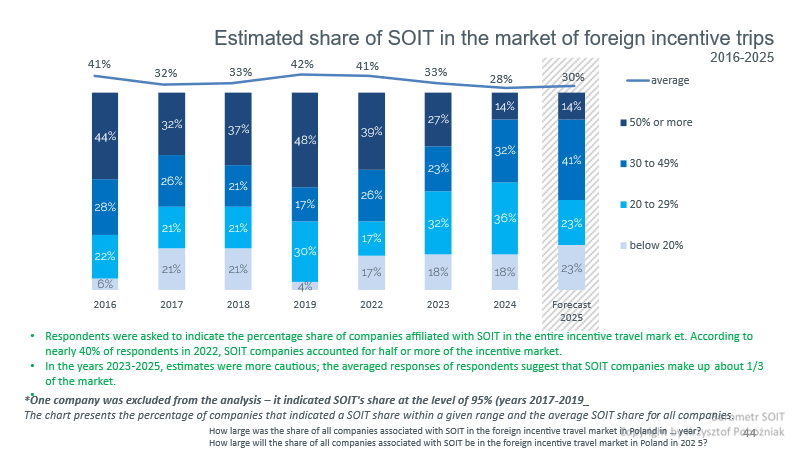

Market Share of SOIT Member Agencies

Market Turnover

- In 2024, the estimated market value for incentive travel increased by almost 100 million PLN compared to 2023.

- A minimal increase in the incentive market size is expected in 2025, though it should not exceed 1 billion PLN.

Owner Mood’s

- The COVID-19 pandemic caused the worst sentiment among survey participants in the history of the SOIT Barometer.

- In 2022, there was a significant improvement in the mood of agency owners and managers, but the record optimism from 2019 did not return.

- From 2023 to 2025, there has been a decline in the highest ratings. A larger percentage of companies indicated a worse mood at the time of the survey than at the end of 2024.

Factors Influencing Sentiment:

The market’s uncertain situation, which is dependent on the global political and economic context, certainly plays a role. The war at the eastern border, various micro and macroeconomic factors, and the aftermath of the pandemic all have a tangible impact on owner sentiments. After experiencing the pandemic, owners are more cautious and less optimistic about their businesses.

Conclusion of the Tenth Anniversary Edition of the Barometer

The tenth anniversary edition of the SOIT Barometer clearly shows that Polish incentive travel agencies are effectively adapting to changing economic and geopolitical realities, including the war at the eastern border and dynamic macro- and microeconomic shifts. For the second consecutive year, the report also includes domestic implementations, which constitute a significant part of the member agencies’ activities.

The presented data not only serve as a crucial reference point for the industry but also provide valuable insights for business partners, such as airlines, global hotel chains, and organizations involved in the promotion of tourist destinations.

The open version of the study is available for download – fill out the form and download:

We also invite you to contact us for the paid version of the Barometer, which includes an in-depth data analysis and serves as a valuable source of knowledge and an excellent reference point for making business decisions.

Cost of the extended version of the study: 2000 PLN

For inquiries, please contact us at: biuro@soit.net.pl